Table of Contents

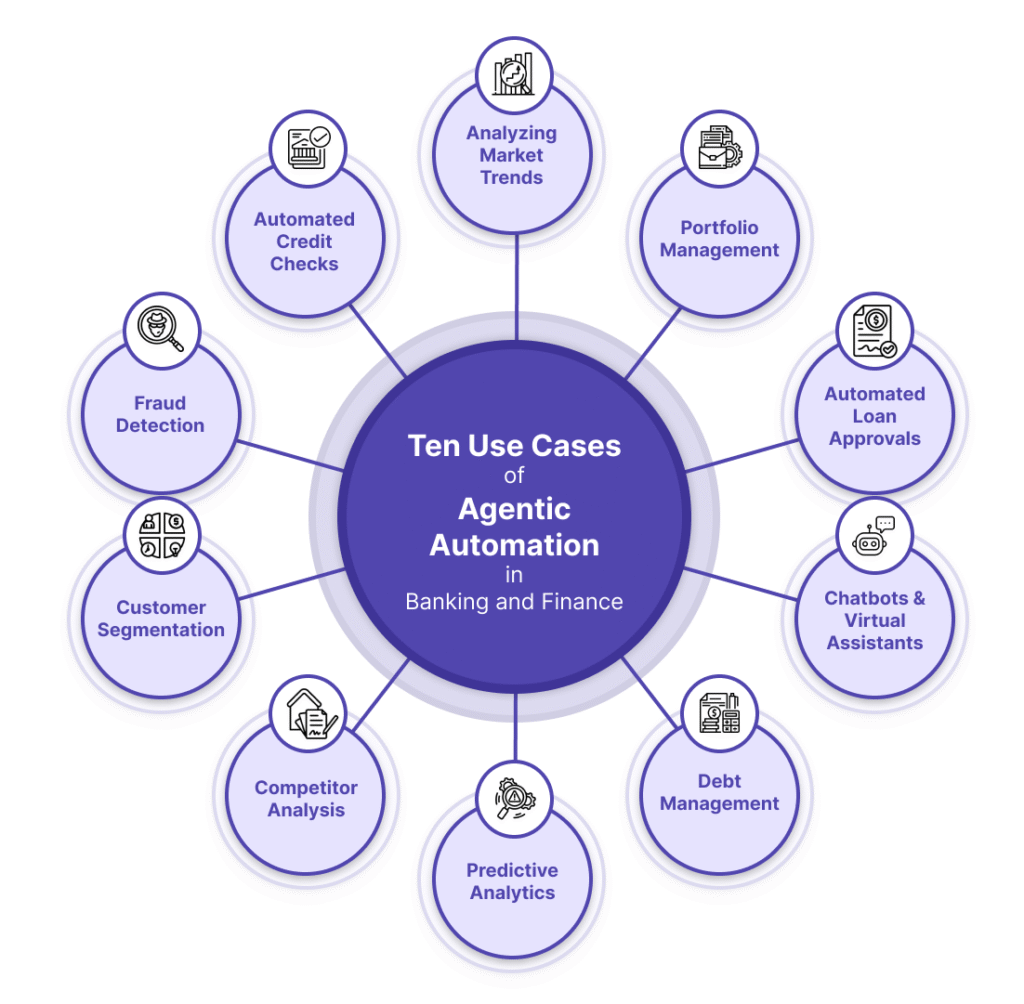

Benefits and Use Cases of Agentic AI in Banking

In the rapidly evolving financial landscape, banks are increasingly turning to Agentic Artificial Intelligence (AI) to enhance operational efficiency, improve customer experiences, and navigate complex regulatory environments. Unlike traditional AI systems, Agentic AI operates autonomously, making decisions and taking actions without human intervention. This capability is transforming various facets of banking, from customer service to risk management.

What is Agentic AI?

Agentic AI refers to AI systems designed to perform tasks autonomously, make decisions, and take actions without human oversight. These systems are equipped with advanced machine learning algorithms, natural language processing capabilities, and decision-making frameworks that enable them to handle complex tasks in real-time.

Benefits of Agentic AI in Banking

1. Enhanced Operational Efficiency

Agentic AI streamlines banking operations by automating routine tasks such as data entry, transaction processing, and compliance checks. This automation reduces the workload on human employees, allowing them to focus on more strategic activities. For instance, AI-driven systems can reconcile accounts, process loan applications, and manage customer inquiries without human intervention, leading to significant time and cost savings.

2. Improved Customer Experience

By leveraging natural language processing and machine learning, Agentic AI can provide personalized and responsive customer service. AI-powered chatbots and virtual assistants can handle a wide range of customer queries, from checking account balances to providing financial advice. This 24/7 availability enhances customer satisfaction and loyalty.

3. Advanced Fraud Detection and Risk Management

Agentic AI systems can analyze vast amounts of transaction data in real-time to identify suspicious activities and potential fraud. By recognizing patterns and anomalies, these systems can flag fraudulent transactions and mitigate risks before they escalate. This proactive approach helps banks protect their assets and maintain customer trust.

4. Streamlined Compliance and Regulatory Reporting

Navigating the complex regulatory landscape is a significant challenge for banks. Agentic AI can automate compliance processes by monitoring regulatory changes, ensuring adherence to laws, and generating accurate reports. This automation reduces the risk of human error and ensures timely compliance with evolving regulations.

Use Cases of Agentic AI in Banking

1. Loan Underwriting and Credit Scoring

Traditional loan underwriting processes are often time-consuming and prone to human bias. Agentic AI can analyze alternative data sources, such as transaction history and social behavior, to assess creditworthiness more accurately and inclusively. This approach enables faster loan approvals and expands access to credit for underserved populations.

2. Anti-Money Laundering (AML) and Fraud Prevention

AML compliance requires continuous monitoring of transactions to detect suspicious activities. Agentic AI systems can autonomously analyze transaction patterns, identify potential money laundering activities, and generate alerts for further investigation. This capability enhances the bank’s ability to combat financial crimes effectively.

3. Customer Onboarding and KYC Processes

Know Your Customer (KYC) procedures are essential for preventing identity theft and fraud. Agentic AI can automate the KYC process by verifying customer identities through document analysis and biometric recognition. This automation accelerates onboarding, reduces errors, and improves the customer experience.

4. Personalized Financial Advisory Services

Agentic AI can analyze a customer’s financial behavior and goals to provide tailored investment advice. By considering factors such as spending patterns, risk tolerance, and market trends, AI-driven advisors can recommend personalized financial strategies, helping customers make informed decisions.

5. Chatbots and Virtual Assistants

AI-powered chatbots can handle a wide range of customer inquiries, from account balance checks to transaction histories. These virtual assistants provide instant responses, reducing wait times and freeing up human agents to handle more complex issues.

Challenges and Considerations

While Agentic AI offers numerous benefits, its implementation in banking comes with challenges:

- Ethical Concerns: The use of AI in decision-making processes raises ethical questions regarding transparency, accountability, and potential biases in algorithms.

- Data Privacy and Security: Handling sensitive financial data requires stringent security measures to prevent breaches and unauthorized access.

- Regulatory Compliance: Banks must ensure that AI systems comply with existing regulations and standards, which may vary across jurisdictions.

Future Trends

The future of Agentic AI in banking looks promising:

- Human-AI Collaboration: Rather than replacing human workers, AI will collaborate with them, augmenting their capabilities and improving overall efficiency.

- Integration with Blockchain: Combining AI with blockchain technology can enhance security and transparency in financial transactions.

- Advanced Predictive Analytics: AI systems will evolve to provide more accurate forecasts, aiding in investment strategies and risk management.

Conclusion

Agentic AI is revolutionizing the banking sector by automating processes, enhancing customer experiences, and improving risk management. While challenges exist, the potential benefits make it a compelling investment for forward-thinking financial institutions. As technology continues to advance, the role of Agentic AI in banking will undoubtedly expand, leading to more efficient, secure, and customer-centric financial services.